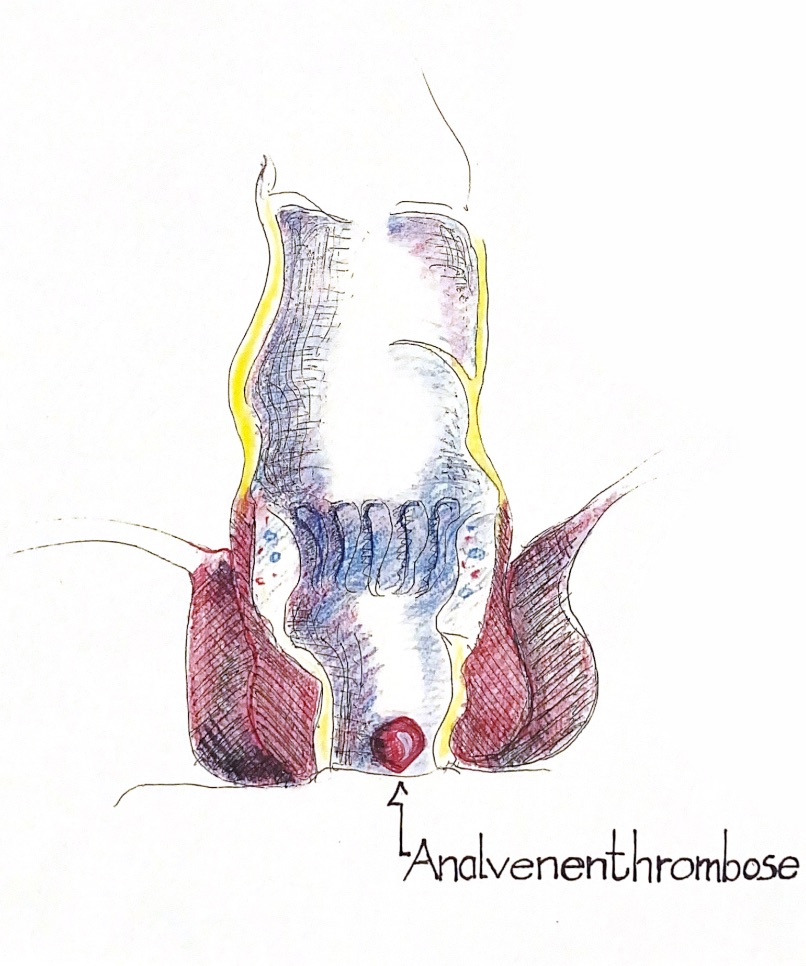

Analvenenthrombose

Es handelt sich um eine schmerzhafte Schwellung meistens am Afterrand, die häufig ohne ersichtlichen Grund auftritt. Analvenenthrombosen sind kleine Blutgerinnsel in den Venen am Afterrand. Sie haben nichts mit Bein- oder Beckenvenenthrombose zu tun. Auch per se nichts mit Hämorrhoiden. Jedoch zu unterscheiden von Analvenenthrombosen sind die vorgefallenen (ausgetretenen) Hämorrhoiden mit zusätzlicher Thrombosierung aufgrund einer Einklemmung. Hierbei handelt es sich jedoch um ein anderes Krankheitsbild.

Die relativ harmlosen Analvenenthrombosen resorbieren sich i. d. Regel in zwei bis drei Wochen und können mit einem kleinen Hautzipfel (Mariske) ausheilen. Hierbei empfiehlt sich die Anwendung von abschwellenden und schmerzlindernden proktologischen Salben sowie eine Stuhlregulierung mit Quellstoffen (z. B. indische Flohsamenschalen). Die Thrombose kann auch aufplatzen, dies führt zu einer Blutung. Der Schmerz lässt dann häufig schlagartig nach. In ausgesuchten, selteneren Fällen kann eine Analvenenthrombose auch operativ in lokaler Betäubung oder Narkose ausgeschnitten werden. Die Wundbehandlung ist meist unproblematisch und die Wundheilung relativ schnell abgeschlossen.